I am not yet a pro when it comes to investing in the stock market. I admit that i am still young and naive. Most have decades of experience, and it’s they you should salute. I’ve only been in the market for ~ 2 years now, and it’s been a series of ups and downs – this is a story of one of my lowest downs.

So how did i start investing in the stock market?

- First year college I heard about it from a friend – but they invested directly through a bank – though I’m not sure how they manage their portfolio.

- I’m an avid reader, and i came across the book: “Think and grow rich by Napoleon Hill”, read more books from Kiyosaki and got very interested in wealth building.

- I opened my first broker’s account (COL Financial) midway between my second and third year of college.

- Slowly started to to invest my income from freelancing. Still not very serious.

- On my supposedly fourth year on college, I went on an internship in Makati City before dropping out.

- I attended ROI (Regina Online Investing)’s seminar on the stock market in their main office in BGC, and only then did I have a strategy, and learned about fundamental analysis around May 2016.

- Col Financial hosted a recent talk on technical analysis last September 2017 and got introduced to trading and the importance of technical analysis.

- Bought more books on technical and fundamental analysis because I realized my strategy and mindset wasn’t very good yet

- Got more involved in trading blue chips in the stock market

- Made gains, but also made my fifty thousand peso mistake

- Bought more books on technical and fundamental analysis because I realized my strategy and mindset wasn’t very good again – started reading on Buffet, Graham and value investing

- Currently invested on index funds while learning to build and plan a portfolio – and learning companies

So, even though I started > 2 years ago, it was years of trial and error and a series of mistake. And I’m not even sure of what to do yet. Because take not, i also have a job, went to university and i can’t do stocks full time.

I’m a firm believer that if I repeat the same mistake, I’m not only incompetent but stupid. A fifty thousand peso mistake made me buy more books and devour more information, and it made me sleepless and guilty for a few nights. So if I do commit the same or a bigger mistake, God forbid, I will let you know so you won’t have to repeat it. (Actually found a recent vid on how one OFW made a 1.8m mistake because of one stock)

You might be a little bit scared now. I was. But then, losing is part of life. And it sometimes serve as your leverage for you to go higher. But I don’t believe in continually making mistakes. Because that either makes you a lazy ass who don’t even bother to learn how to improve.

Things I’ve learned

1. Never get started if you are not yet ready

But if you do want to get started now, you can try doing low-cost index funds which track the psei – it’s like owning all stocks in the index, without having big money. That way, as you work on improving your stock picking abilities and company evaluation skills, you can ride on the current wave as the psei grows.

When I got started, I used to have more than 10 companies in my portfolio – but I realized it wasn’t optimal. And my capital is not yet that big. It not only diminished the returns I could possibly get, but it also made me pick any blue chip stock blindly, and relied on the online broker’s research.

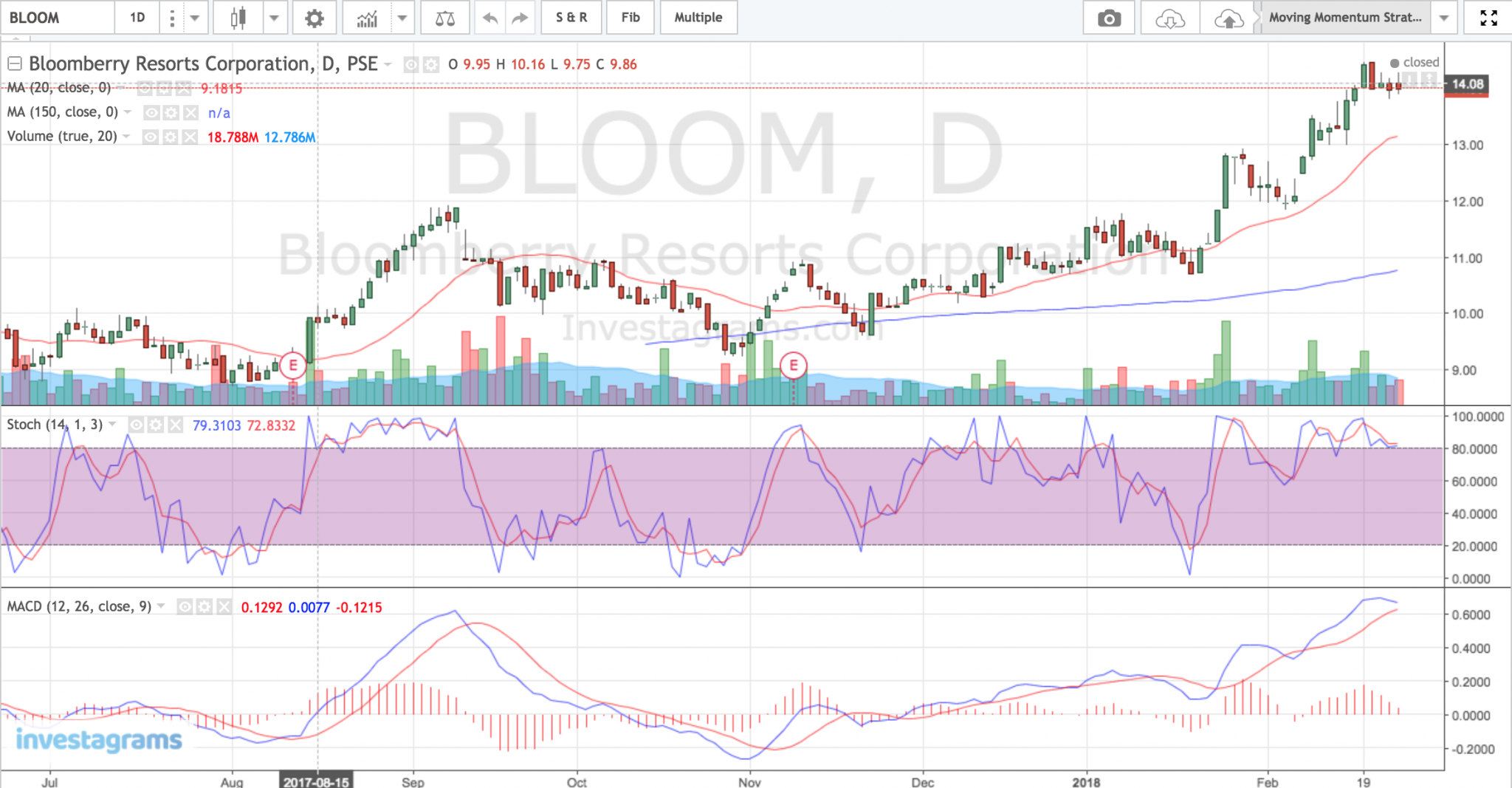

Better yet, try online platforms like Investagrams, which allows you to simulate real-life trading. They also host trading competitions, where you get to practice your trading strategy.

Also, read books. Authors from PH like Marvin Germo and Colayco are just as awesome as those authors abroad. In fact, if you’d ask me for advice, it’s much better to buy books from these authors! I was practically raised by books of Marvin! Not only do their books directly apply to our OWN market, but you can read relatable experiences. Also, what i like most about Marvin’s books is that it’s very easy to ready, and i’ve got all books from his series (it’s very worth it). If i were to write my own book for fellow Filipinos, i’ll definitely learn the way he writes.

2. Never buy then pray

Often, we get too excited about the news or the research released by our broker on a company – we buy it, and often we end up praying it will do good.

No.

I made a costly mistake because I relied on the reports. I didn’t have any conviction that the company will do good. Because I didn’t even bother looking at its audited financial statements. How it currently is making money or how it will probably do with the current state of the economy. So, when news that the owner is selling a percent of his shares came out, it plummeted down, and I was at a 20% loss. I never bothered checking out if anything changed fundamentally so I sold it. It was very easy to sell it – and the paper loss became more and more real. So, currently the share price is back at a 6% loss, and It could have saved me a lot if I knew what I bought before buying it. (PS: It was a good stock! And the year after, i would have made great gains)

How it affected me today

1. It made me realize my risk appetite, and real strategy

I can’t possibly trade full-time. I’m a freelancer, and even though trading seems to be a good career, it’s not something i want to do full-time. I can be aggressive on my portfolio, because i have more than enough emergency and buffer funds at my disposal. But, i can’t check my portfolio every minute of the day. That is why Graham’s investment philosophy really appealed to me. I now better understand how long i’m willing to wait – 10, 20 years i don’t care, as long as i’m picking great companies.

2. Have a clear mind on speculation

Right now, when i see speculative news on how surely such company stocks will rise, i not only disregard it, but i shrug it off with disgust. There’s nothing wrong with trying to make a profit. I understand that, but i’m not driven to dive into the hype now, because i already know it’s not something i like. And i don’t know the company yet (unless it’s one of the companies i’m watching)

Also, with the hype on bitcoin and cryptocurrencies, never have i ever bought a single coin (though truthfully when it hit 20k, i was almost almost tempted). Because, i know it’s been driven by greed and speculation. And i can’t even buy anything with bitcoin in PH. And, contrary to what people say, it’s not INVESTING.

Conclusion

As a conclusion, i’d like to point out that although i can talk to you for hours about the stock market, companies, economies – i still consider myself a noob when it comes to investing. There’s so much more i need to learn, and i will continue learning. That is why i hunt for great authors, successful mentors, and events that would allow me to be better.

You know, if you’d like to have a cup of coffee with me, let me know 🙂 I’m a good listener, and I learn fast. I am always always eager to learn, too.